[ad_1]

Following the listings of a number of restaking tasks, together with KernelDAO, Solayer, and Babylon – on Binance in Q2 2025, one query emerges: Is “restaking” turning into the subsequent dominant narrative within the crypto market?

What Is Restaking and Why Does It Matter?

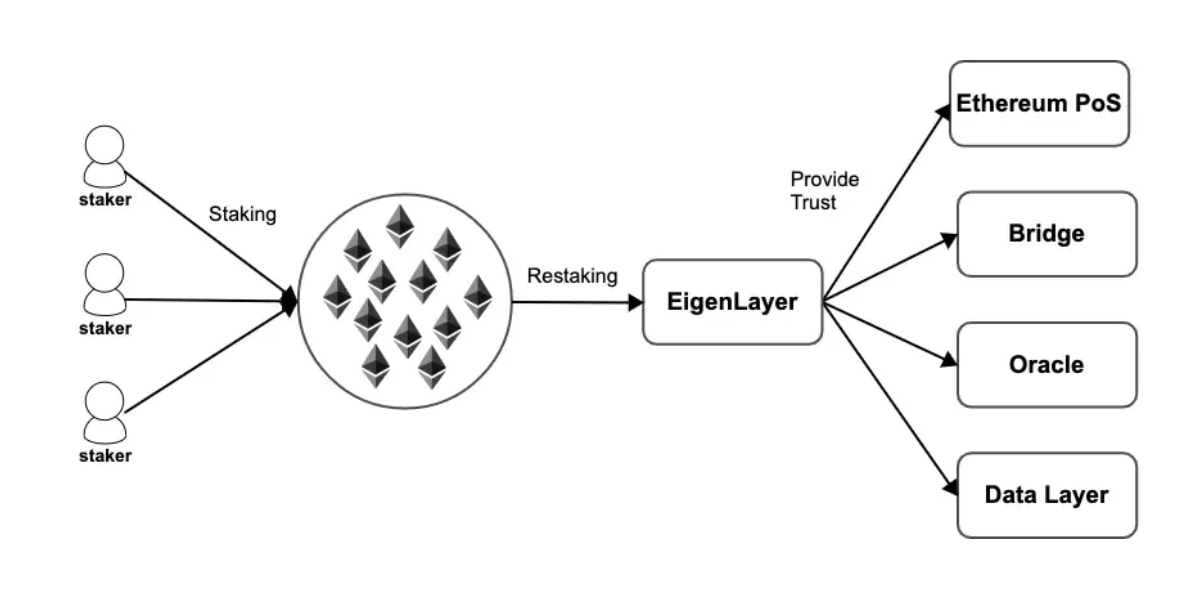

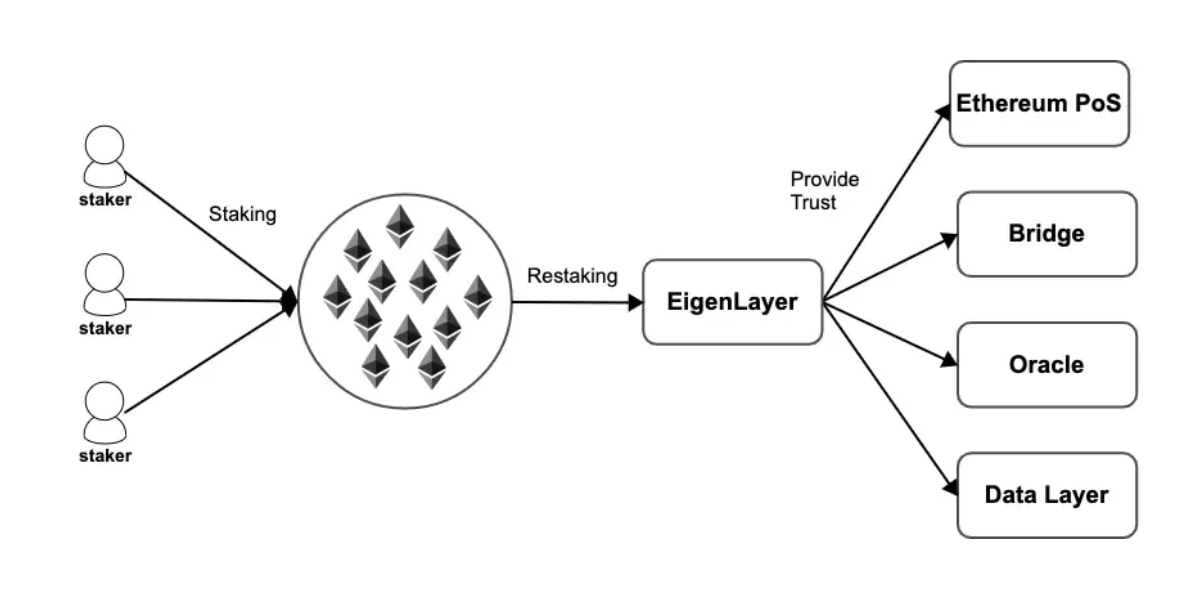

Restaking is a mechanism that permits customers to reuse staked property (usually ETH) to safe different networks or purposes with out having to withdraw these property from the unique staking platform. This represents a significant breakthrough in capital effectivity inside blockchain ecosystems, because it allows a single pool of property to be utilized for a number of safety functions, fostering the expansion of recent infrastructure layers with out compromising the integrity of the bottom community.

This mechanism considerably lowers the safety barrier for brand new tasks. Historically, launching a brand new blockchain or appchain meant securing a devoted validator set and sourcing new staking capital. With restaking, tasks can “lease” safety from already-staked tokens on Ethereum or suitable chains, thereby lowering time-to-launch and boosting early-stage belief.

The idea of restaking was pioneered by EigenLayer, a undertaking broadly anticipated to grow to be the secondary safety pillar of Ethereum. EigenLayer permits customers to restake ETH already secured on Ethereum to supply safety for auxiliary modules corresponding to oracles, bridges, or rollups. Initially, EigenLayer targeted on enabling builders to construct plug-and-play safety modules, however this has developed into a whole ecosystem dubbed “Restaking-as-a-Service.”

Learn extra: What’s Restaking in Crypto? The Newbie’s Information

Supply: EigenLayer

This mannequin isn’t restricted to Ethereum. Different chains like Solana and BNB Good Chain have additionally begun integrating or enabling comparable approaches, leveraging their native tokens (e.g., SOL, BNB) to develop staking mechanisms in a extra versatile manner — aligning with the modular safety calls for of the subsequent technology of Web3 infrastructure.

The Restaking Ecosystem Is Quickly Increasing

As of April 2025, a number of main restaking tasks have made notable progress:

KernelDAO (BNB Chain): The primary native restaking protocol on BNB Chain, backed by Binance Labs. After itemizing on Binance on April 14, KERNEL’s token reached a completely diluted valuation (FDV) of over $300M earlier than sharply correcting to the $0.17 vary. Nonetheless, it stands as a transparent testomony to the rising attraction of the restaking narrative inside the Binance group.Solayer (Solana): A pioneer in bringing “liquid restaking” to the Solana ecosystem, Solayer permits customers to stake SOL whereas receiving liquid property to proceed collaborating in DeFi. The undertaking was listed on Binance on April 22 with an preliminary FDV of roughly $900 million. Solayer additionally plans to combine restaking modules for Actual World Belongings (RWA) and Web3 gaming.Babylon (Bitcoin): Increasing the idea of restaking to Bitcoin, Babylon allows BTC holders – usually holding a non-yielding asset, to safe appchains or rollups. With a modular safety mannequin and backing from main funds like Polychain and Binance Labs, Babylon was listed on Binance on April 25 and shortly turned one of many high 5 most traded new tokens of the week.

Why Restaking Dominated in 2024

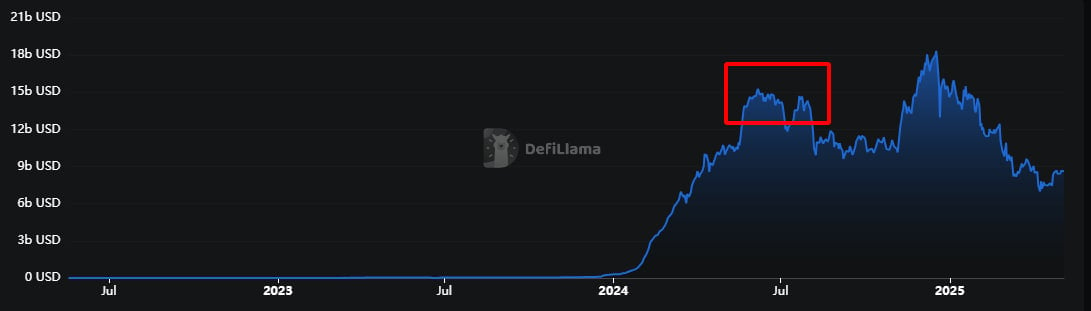

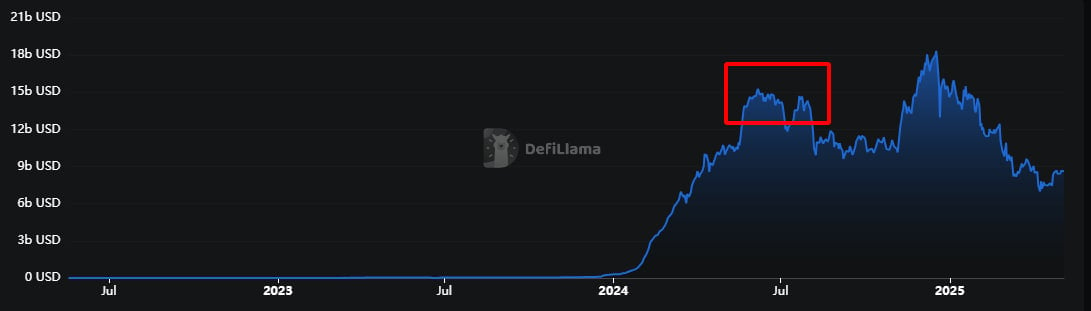

The restaking narrative rose to prominence in late 2023 by way of protocols like EigenLayer, which launched a novel thought: utilizing staked property (particularly ETH) to safe further providers corresponding to oracle networks, knowledge availability layers, and appchains. This idea quickly gained traction for a number of causes:

Capital Effectivity: Customers may earn layered yield by repurposing already-staked property.Safety-as-a-Service: New protocols now not wanted to bootstrap validator networks from scratch.Protocol Income: Restaking opened new income streams for infrastructure and middleware tasks.

EigenLayer’s meteoric rise, coupled with strategic enterprise capital backing, made restaking the defining infrastructure narrative of that cycle.

Liquid Restaking Protocols’ TVL rise considerably in 2024 – Supply: DeFiLlama

Can Restaking Make a Comeback in 2025?

Whereas narratives like AI x Crypto, SocialFi, and Modular Gaming have dominated early 2025 headlines, the latest listings of KernelDAO, Solayer, and Babylon recommend a rekindling of curiosity in restaking infrastructure. These new entrants mirror a maturation of the narrative, spanning a number of chains (BNB, Solana, Bitcoin) and broadening use instances past Ethereum.

Nevertheless, whether or not restaking can reclaim its standing as the highest narrative stays unsure. A lot will rely upon:

Actual adoption of restaked safety throughout rollups, video games, and RWAs.Regulatory readability round staking-as-a-service.Continued innovation in modular design and cross-chain compatibility.

If these elements align, restaking may as soon as once more transfer from narrative to necessity, providing the spine for the subsequent section of decentralized safety infrastructure.

The speedy succession of restaking undertaking listings on Binance has remodeled what was as soon as thought-about a “technical area of interest” into one of the dominant funding narratives of Q2 2025.

MilkyWay stands out on BNB Chain, aiming to develop decentralized safety for satellite tv for pc chains in Web3. As a substitute of conventional BNB staking, customers restake to safe apps and earn MILK with out shedding liquidity.

The MILK token launched through Binance Pockets by way of a Pockets Preliminary Providing (WIO) on April 29, 2025. This isn’t only a new decentralized fundraising mannequin. It’s additionally a powerful sign that Binance is giving MilkyWay particular consideration, just like its assist of KernelDAO and Babylon.

Study extra: Milkyway Worth Prediction

Supply: MilkyWay

MilkyWay makes use of a multi-layered structure to allow cross-chain staking between Ethereum and BNB Good Chain. This not solely extends its safety base but in addition enhances compatibility with DeFi tasks throughout each ecosystems.

In contrast to Puffer Finance (PUFFER) and Swell (SWELL), which confronted airdrop sell-offs, MilkyWay could profit from a light-weight FDV technique. MilkyWay retains valuation conservative and grows TVL steadily to assist wholesome post-listing efficiency.

Conclusion

Three listings in two weeks—KernelDAO, Solayer, and Babylon, present Binance backs the restaking narrative. Because the market recovers, restaking grows past tech, turning into a key pillar of the Web3 ecosystem.

MilkyWay is probably going the subsequent piece on this rising development. Buyers ought to observe unlocks, TVL development, and Binance ties to gauge MILK’s medium-term potential.

Restaking was as soon as a imaginative and prescient. Now, it’s turning into a actuality – validated by the market itself.

Learn extra: Prime 5 Pre-TGE Tasks Backed by YZI Labs (Binance Labs)

[ad_2]

Source link