[ad_1]

The most important asset supervisor on this planet, BlackRock, has proposed to the U.S. Securities and Alternate Fee (SEC) to allow staking inside Ethereum Alternate-Traded Funds (ETFs), which is a revolutionary step for the cryptocurrency market.

🇺🇸 @BlackRock meets @SECGov Crypto Activity Drive to debate:

🔹 Staking in crypto ETPs🔹 Securities tokenization

📊 BlackRock pushes for Ether ETF staking & eyes tokenized funds like its $2.9B BUIDL#BlackRock #SEC #Ethereum #ETF #Crypto pic.twitter.com/tpg9tdxV4P

— Crypto Information (CoinGape) (@CoinGapeMedia) Could 10, 2025

All eyes on Ethereum ETF staking

This proposal has the potential to alter the crypto funding panorama by turning Ethereum ETFs into yield-generating belongings just like bonds.

To permit the creation and redemption of ETF shares utilizing ETH somewhat than USD, BlackRock is proposing to amend its S-1 submitting. Utilizing BlackRock’s $2.9 billion BUIDL fund, a tokenized fund that was launched in March 2024 and concentrates on typical belongings like U.S. Treasury payments (T-bills) on the Ethereum community, this transformation seeks to mix staking and tokenization techniques.

The BUIDL fund is a major instance of BlackRock’s overarching plan to combine decentralized programs with conventional finance, with Ethereum serving as a key element of this improvement.

If permitted, staking in Ethereum ETFs may yield roughly 3.2% yearly, per market analysis. This potential return is anticipated to draw important institutional funding in Ethereum, giving traders the possibility to learn from each capital development and passive earnings.

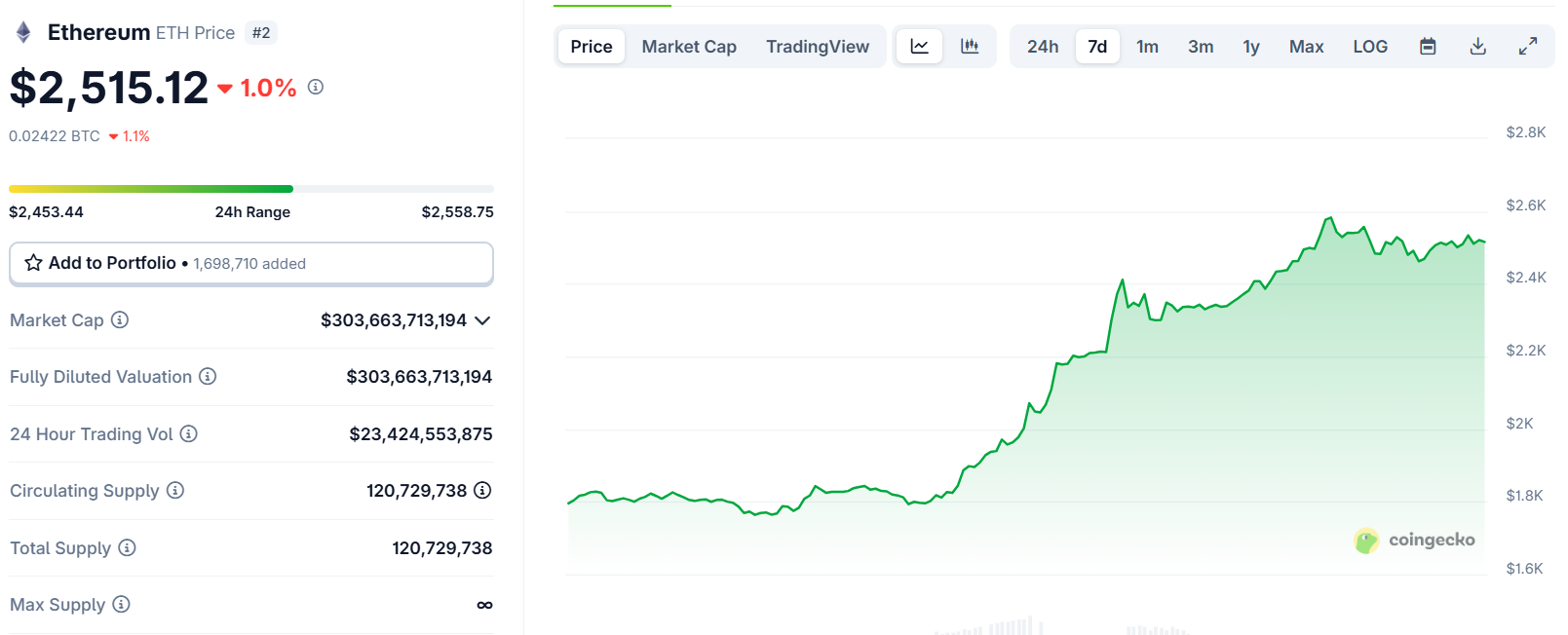

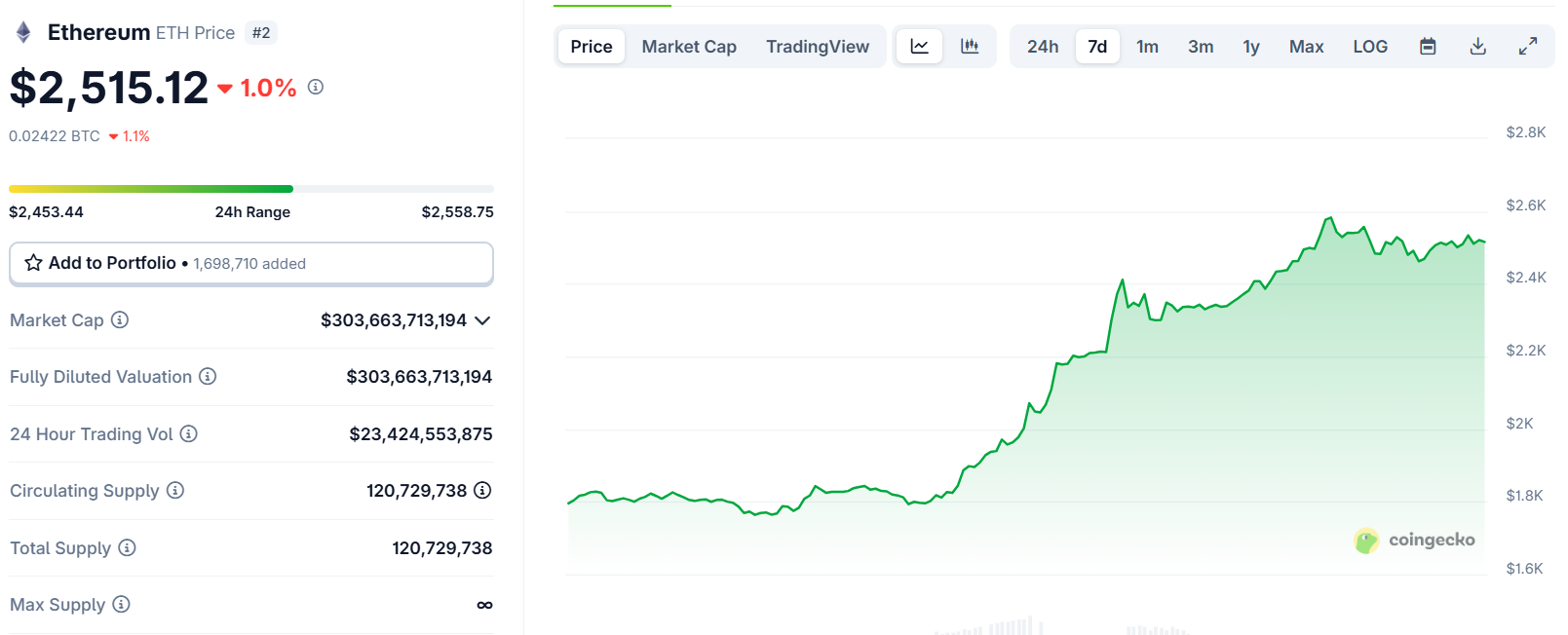

The market has already priced it in as traders await the SEC’s determination; over the previous seven days, ETH has elevated by practically 40%, outpacing Bitcoin and different notable cryptocurrencies.

Supply: CoinGecko

SEC turns optimistic fueling extra ETFs proposal

The SEC has traditionally regarded staking as a possible unregistered safety below the Howey Check, a authorized framework used to find out whether or not an asset qualifies as an funding contract. Staking is particularly prohibited at launch for Ethereum Spot ETFs, which had been accredited by the SEC in Could 2024. This has generated controversy within the monetary group and has been a major barrier to staking integration into ETFs.

A extra crypto-friendly SEC in 2025 seems to be inspecting these restrictions and probably paving the best way for regulatory approval, primarily based on updates on SEC.gov.

In a March 2025 interview with CNBC, Robert Mitchnick, head of digital belongings at BlackRock, highlighted the revolutionary potential of staking for Ether ETFs.

“Approval of this characteristic may considerably increase investor curiosity,” he mentioned, “though Ethereum ETFs have seen lackluster demand since their July 2024 debut, largely because of the absence of staking.”

Mitchnick mentioned, “An ETF has been a compelling car for holding Bitcoin, but it surely’s much less good for ETH at present with out staking.” He additionally emphasised the necessity for regulatory readability to completely understand Ethereum’s potential in institutional portfolios.

The Ether ETF staking proposal has ramifications that transcend the value of Ethereum. By permitting staking in ETFs, cryptocurrency belongings could possibly be reframed as devices for each earnings era and capital appreciation, bringing them nearer to standard Wall Avenue monetary merchandise.

Learn extra: SEC Boosts Bitcoin and ETF Altcoins by PoW Compliance

This modification may usher in a brand new period for cryptocurrencies, bringing them nearer to mainstream monetary integration and away from their decentralized roots. The cryptocurrency market is retaining a detailed eye on the SEC’s deliberations, with Ethereum presumably spearheading the push for a hybridized monetary future.

[ad_2]

Source link