[ad_1]

Oversaturation of Tokens: Fragmented Quantity within the Crypto Market

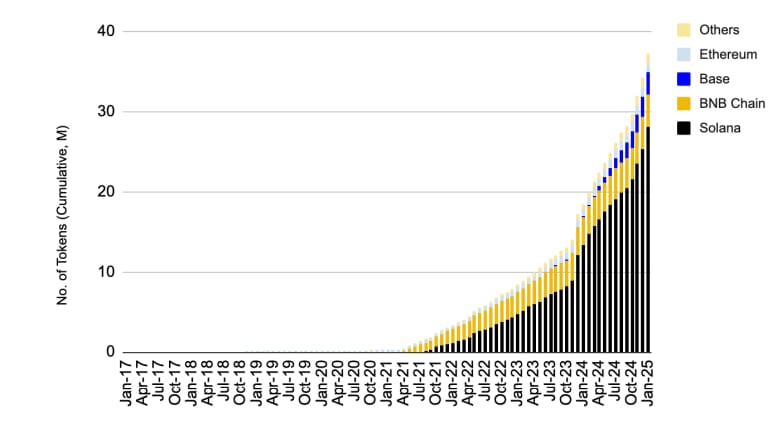

The variety of new tokens on the crypto market is skyrocketing, already totaling over 37 million. Vital market fragmentation outcomes from the each day introduction of latest cash into the ecosystem. Attributable to investor curiosity and liquidity being dispersed all through an increasing pool of belongings, this overstock has precipitated buying and selling volumes to turn into diluted.

Spreading commerce quantity throughout a number of tokens reduces liquidity for particular person cash. Low liquidity makes it more durable for merchants to hold out important transactions with out affecting costs, which ceaselessly ends in elevated value volatility. Institutional and strange buyers could discover it tough to differentiate currencies with strong fundamentals from the variety of new initiatives due to this fragmentation.

Supply: Binance Analysis

The steep value declines that happen after TGE are one worrying pattern within the cryptocurrency area. Following the launch of their tokens, well-known tasks like Azuki, Story Protocol, and Berachain have had harsh dumps.

Following its TGE, the much-anticipated undertaking Berachain had a pointy drop in value, leading to important losses for early buyers. Story Protocol, which targeted on content material technology infrastructure, noticed an analogous drop in value following TGE and didn’t maintain its preliminary enthusiasm. Azuki, which was well-known for gathering NFTs, additionally confronted challenges; the token’s worth plummeted quickly after its launch.

These patterns point out that the hole between pre-launch enthusiasm and post-launch outcomes is widening. After a TGE, many tokens lose worth, which begs the query of how helpful they’re and the way a lot buyers belief these sorts of enterprises.

Investor Sentiment Shifts Amid Market Saturation

Traders have gotten extra cautious due to the growing quantity of tokens and the frequency of post-TGE dumps. Tasks with sustainable fashions and validated use circumstances have gotten an increasing number of fashionable. Since it’s tough to identify promising probabilities attributable to oversaturation, this alteration demonstrates a choice for high quality over amount.

Furthermore, buyers are rising cautious of speculative debuts. Tasks that don’t stand out or make progress after TGE are most likely going to lose favor. Due to this, it’s now needed for contemporary tokens to exhibit distinct worth propositions and powerful foundations with the intention to garner sustained curiosity.

The fast development of tokens has led to a fragmented buying and selling surroundings, in accordance with statistics from current market stories. The typical buying and selling quantity for particular person tokens is reducing as extra tokens are launched. This lowers the potential for regular value stability along with having an impression on liquidity.

Exhausting dumps are occurring for tasks which are unable to acquire strong group help and continued improvement after TGE, with costs falling by double-digit percentages. For instance, inside weeks of its inception, Azuki’s token fell by greater than 50%, indicating an absence of belief within the undertaking’s plan. Tasks discover it harder to revive momentum as soon as these extreme dumps deter potential buyers.

Due to the state of the market, new tasks must be progressive and credible as within the case of Hyperliquid. Token launches should produce quantifiable outcomes and surpass enthusiasm in a crowded market. To face out, tasks more and more must have sturdy group involvement, open communication, and apparent utility.

[ad_2]

Source link