[ad_1]

As Bitcoin BTC trades above $102,000 for the primary time since March, the market is asking essentially the most urgent query of this cycle: How excessive can Bitcoin go earlier than it peaks?

With macroeconomic headwinds, ETF inflows, and halving results in full swing, predictions vary from conservative to wildly optimistic. However past hypothesis, what do establishments, chart patterns, and knowledge truly inform us in regards to the prime of this cycle?

Institutional Views: From JPMorgan to Commonplace Chartered

Wall Avenue and crypto-native corporations alike are revising their BTC forecasts upward. Earlier this yr, JPMorgan launched a report suggesting Bitcoin may attain $110,000 by year-end 2025, citing rising institutional demand by means of spot Bitcoin ETFs and a weaker greenback setting.

In the meantime, Commonplace Chartered stays one of many extra bullish conventional establishments. In an April notice, the financial institution reaffirmed its goal of $150,000, stating:

“We see structural inflows into Bitcoin persevering with, particularly from sovereign wealth funds and pension managers now capable of allocate by means of regulated ETF automobiles.”

On the extra excessive finish, Ark Make investments’s Cathie Wooden reiterated her long-term projection of $1 million per BTC by 2030 but additionally hinted that this cycle may take a look at $200,000 if ETF inflows keep their present tempo.

In keeping with Farside Buyers, U.S. spot Bitcoin ETFs noticed over $13.1 billion in web inflows since launch in January, with BlackRock’s IBIT main the pack at over $4.8 billion. These sustained inflows, averaging greater than $250 million per week – present a sturdy flooring for BTC and should proceed fueling upside momentum.

Learn extra: JP Morgan: Buyers Desire Gold Over Bitcoin as a Secure-Haven

Supply: TradingView

Furthermore, Ki Younger Ju – CEO CryptoQuant stays cautiously optimistic about Bitcoin’s outlook. He famous that whereas the market is at the moment “gradual in digesting new liquidity,” the latest worth actions recommend sturdy bullish momentum, largely pushed by important ETF inflows and easing promoting strain. Nevertheless, he additionally emphasised that market indicators stay combined, with no clear indication but of whether or not a profit-taking section has firmly begun or not.

Learn extra: CryptoQuant CEO: “A New Period for Bitcoin has Begun”

On-Chain Indicators: Nonetheless Room to Run?

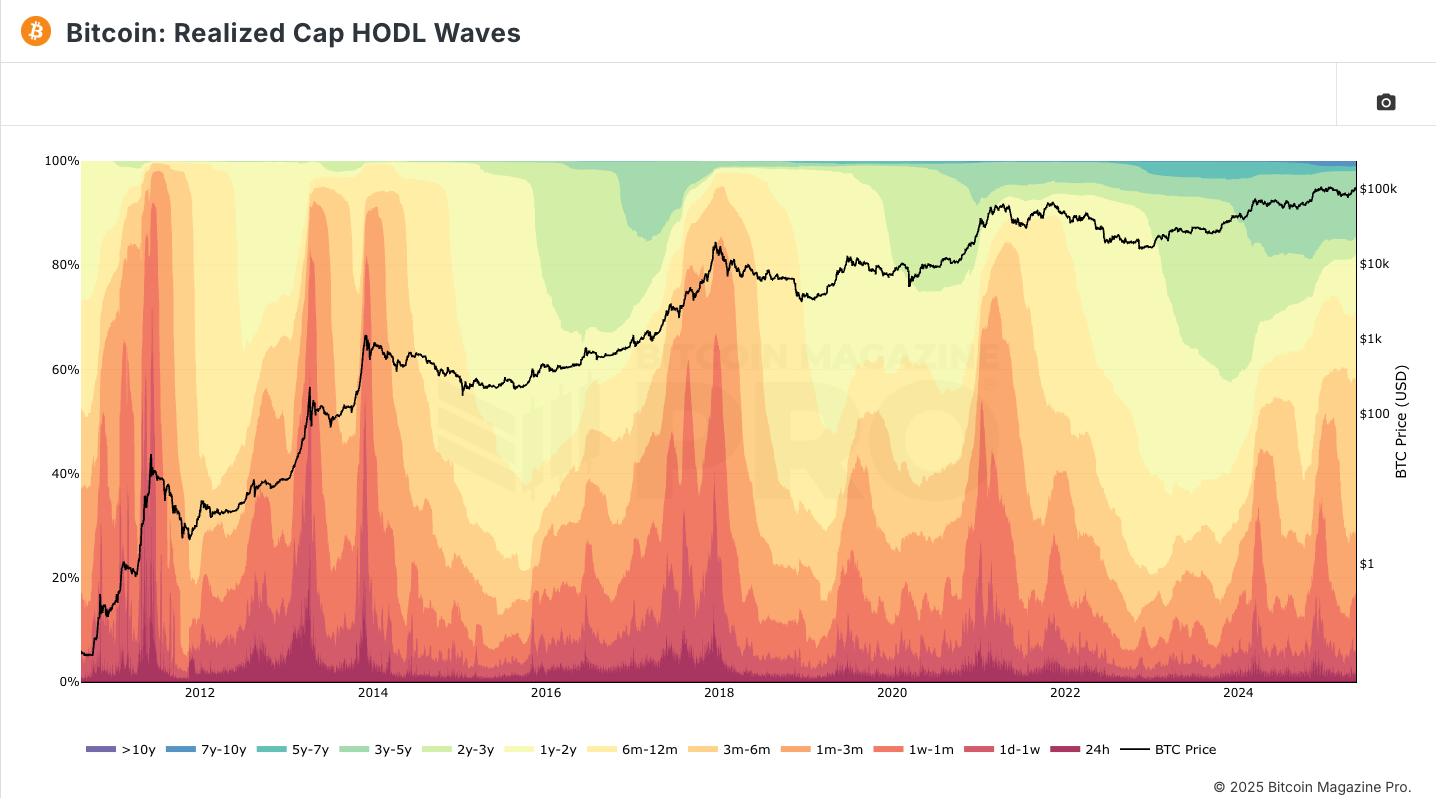

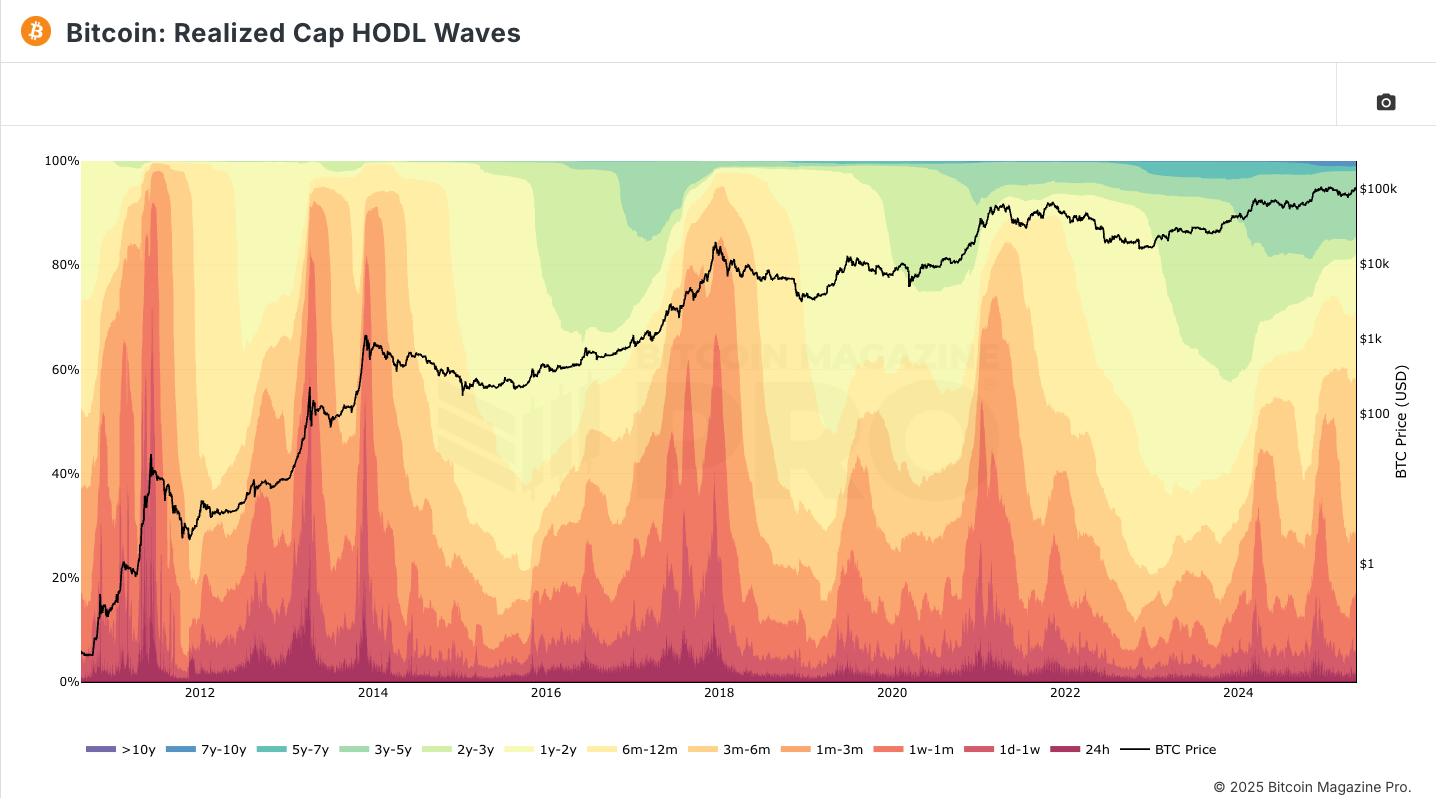

BitcoinMagazine knowledge from Could 12, 2025, reveals that long-term holders are nonetheless in distribution mode, however the magnitude is average in comparison with earlier peaks in 2017 and 2021.

The Realized Cap HODL Waves metric, typically used to visualise age-based distribution patterns, signifies that cash aged 3-6 months are rising, suggesting early-cycle accumulation is evolving into mid-cycle optimism.

Supply: BitcoinMagazine

In the meantime, the MVRV Z-Rating, a preferred indicator evaluating market worth to realized worth, is at the moment hovering round 4.3 – properly beneath the overheated threshold above 7 seen in earlier cycle tops. This suggests that whereas BTC is actually not undervalued, it’s additionally not exhibiting the euphoric overextension attribute of a blow-off prime.

Technical Evaluation: Value Construction Suggests $120K–$140K as Subsequent Targets

From a technical standpoint, Bitcoin just lately broke out of a consolidation vary between $86,000 and $97,000. This vary had acted as resistance for the reason that March prime, and the breakout on Could 10, accompanied by sturdy quantity, suggests the subsequent leg greater has begun.

Supply: TradingView

In keeping with pseudonymous dealer Rekt Capital, the breakout confirms a continuation sample that resembles the 2017 cycle post-halving surge:

“The consolidation construction mirrors what we noticed in Could 2017. If the fractal performs out equally, $120K is the subsequent resistance zone earlier than BTC checks the $140K space.”

Fibonacci extension ranges from the November 2022 backside ($15,600) to the March 2024 excessive ($73,800) place the 1.618 extension close to $128,000 – a traditionally dependable goal in parabolic cycles.

CoinCodex’s algorithmic fashions additionally recommend Bitcoin could rise towards $151,000 by November 2025, regardless of a possible 12.35% pullback within the brief time period.

Macro Circumstances: Tailwinds, However Fragile

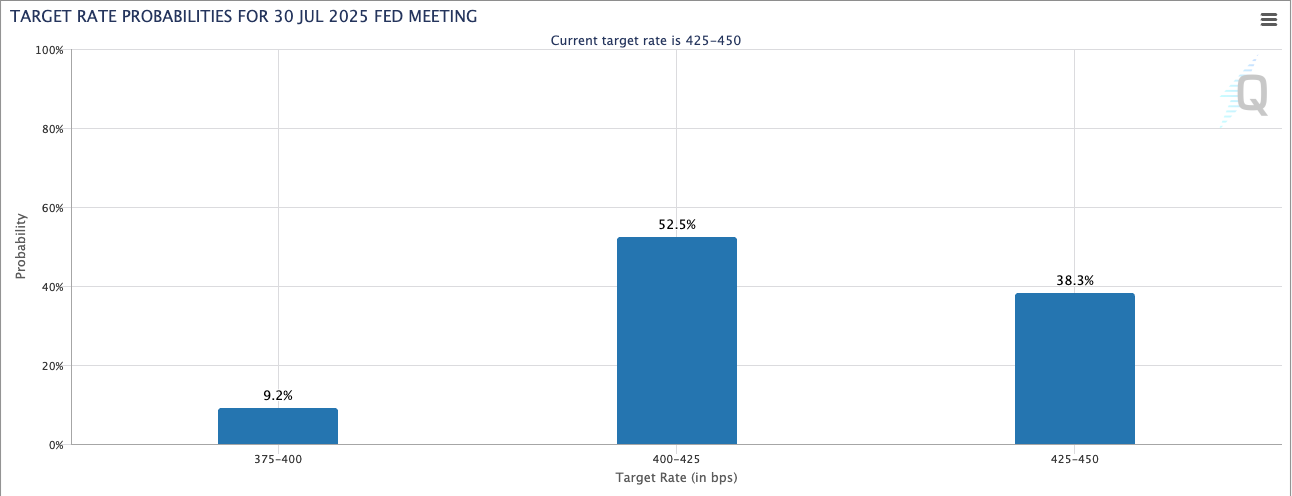

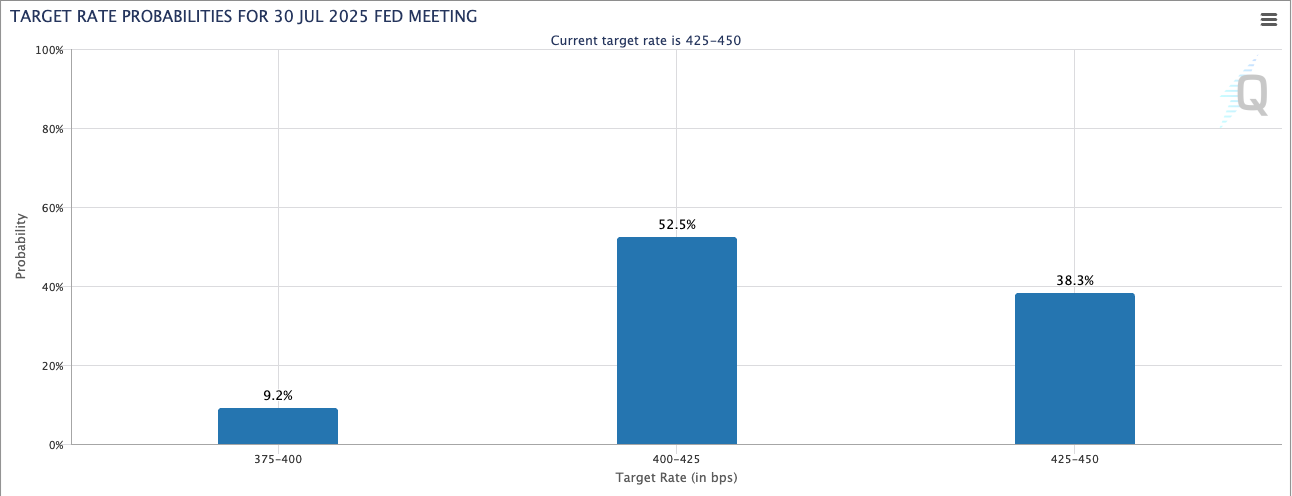

The U.S. Federal Reserve is predicted to start reducing charges in Q3 2025, with the CME FedWatch Instrument pricing in a 75% chance of a 25bps minimize on the September assembly. Decrease rates of interest have a tendency to profit danger property, together with Bitcoin.

Supply: CME Group

Moreover, gold’s latest surge to $2,550 per ounce, pushed by central financial institution shopping for and international geopolitical instability, has renewed the narrative of Bitcoin as “digital gold.” On this local weather, Bitcoin’s capped provide and resistance to inflation make it a horny hedge.

Nevertheless, tail dangers stay. A sudden reversal in ETF flows, tightening liquidity from Asia (significantly Hong Kong and Singapore), or U.S. regulatory crackdowns may all threaten bullish momentum. Some consultants additionally warn that if the U.S. or EU impose strict taxation insurance policies on crypto capital positive factors, or if China intensifies restrictions on stablecoin flows, it may create unfavorable sentiment globally.

Sentiment from Crypto Twitter and Merchants

Influencers like CryptoKaleo and TheFlowHorse have steered that BTC may hit between $135,000 and $160,000 earlier than this cycle concludes, citing each macro and on-chain help. Anbessa100, a TA-focused account with over 300,000 followers, acknowledged:

“So long as we maintain $98K as help, the bullish construction stays intact. There’s a excessive chance BTC sees a remaining thrust towards $140K earlier than topping.”

Nevertheless, derivatives knowledge from Coinglass reveals funding charges exceeding +0.15% on a number of main exchanges, and lengthy/brief ratios above 68% – indicators of overheated leverage that might set off liquidations if worth sharply reverses.

Evaluating Previous Cycles

Traditionally, Bitcoin has peaked 12–18 months after every halving. With the latest halving occurring in April 2024, many analysts imagine the height may arrive between Q2 and This fall of 2025.

In 2013, BTC surged ~10x post-halving; in 2017, the rally was ~20x; and in 2021, round ~6x. From the $15,600 backside in 2022, a 6x transfer would place the cycle prime at roughly $93,600 – already surpassed. A 10x transfer would indicate $156,000.

Nonetheless, this cycle has distinctive traits: ETF inflows, rising nation-state curiosity (e.g., Argentina legalizing BTC as a cost technique), and an accelerating DeFi layer on Bitcoin (e.g., Runes, Ordinals, and Layer 2s).

DeFi protocols like Stacks, Bison Labs, and new Ordinals-based monetary apps are turning Bitcoin into greater than a retailer of worth, doubtlessly boosting demand for the asset itself.

Retail FOMO: Hasn’t Peaked But

Google Traits knowledge for “purchase Bitcoin” is at 41% of its all-time excessive in Could 2021, suggesting retail frenzy hasn’t totally returned. Likewise, Coinbase’s app is simply ranked #27 within the U.S. App Retailer Finance class, far beneath its #1 peak in April 2021.

Learn extra: Buying and selling with Free Crypto Indicators in Night Dealer Channel

These indicators trace that BTC should still have room for one remaining leg up – the section typically pushed by retail hypothesis and media euphoria.

Nevertheless, the shortage of retail-driven indicators is also interpreted in a extra cautious mild: Bitcoin’s rally could not but be sturdy sufficient to maintain itself with out broader participation.

Traditionally, the ultimate parabolic leg of a bull market is accompanied by a surge in retail euphoria and a spike in search curiosity, neither of which has materialized in full. This raises the likelihood that BTC may face a pointy correction earlier than any true blow-off prime happens. When expectations run forward of precise inflows, the market typically sees a shakeout to flush out extra leverage and reset help ranges.

Conclusion

There isn’t any consensus reply. However based mostly on present knowledge, the vast majority of reasonable projections – discounting moonshot predictions like $500K, cluster round $120K to $160K.

If ETF flows stay sturdy, macro circumstances keep favorable, and retail euphoria kicks in, a peak between $140K and $150K appears believable. Nevertheless, merchants ought to stay alert to indicators of overheating, reminiscent of MVRV over 7, parabolic RSI strikes, or extreme leverage in futures markets.

[ad_2]

Source link