After a turbulent quarter within the crypto market, Solana (SOL) is as soon as once more within the highlight as buyers more and more ask: is SOL forming a backside and getting ready for a rebound, or is the downtrend not over but?

As of in the present day, SOL is buying and selling within the $130–$134 vary, considerably beneath its March peak of $205. Nevertheless, technical indicators and capital flows are exhibiting some encouraging alerts, probably laying the groundwork for a short-term restoration.

Technical Indicators Recommend a Quick-Time period Backside for Solana

The $120 stage is presently appearing as essentially the most important technical help for Solana SOL in April. So long as the worth holds above this zone, a short-term restoration towards the $144-$145 vary within the coming weeks stays a sensible risk.

On the each day chart, this zone represents the closest resistance, the place earlier worth rallies have repeatedly confronted rejection. Reclaiming this stage would function a affirmation sign for a transparent short-term pattern reversal.

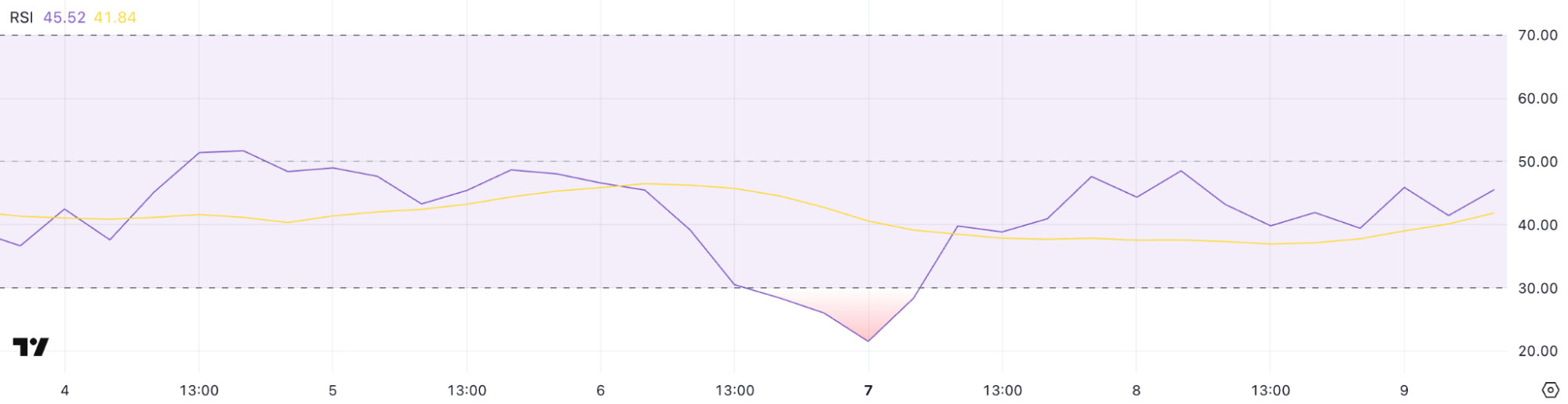

As well as, the Relative Energy Index (RSI)—a momentum indicator used to gauge overbought or oversold situation, fell to round 35 late final week. This stage is commonly interpreted by technical analysts as a sign of an oversold market, suggesting that promoting stress could also be exhausted and {that a} rebound may very well be imminent.

A number of bullish candlestick reversal patterns have additionally began to look on the each day chart, additional supporting the case for a possible short-term bounce.

The RSI fell round 35 final week – Supply: TradingView

Past technical indicators, on-chain information from Coingape offers further insights. Throughout the latest worth consolidation between $125 and $130, there was a notable uptick in buying and selling exercise from whale addresses (wallets holding greater than 100,000 SOL), hinting at accumulation throughout this vary.

The mix of technical evaluation and on-chain conduct paints a comparatively optimistic short-term outlook for SOL heading into the second half of April, offered that macroeconomic situations stay secure. That stated, a each day shut above $145 with sturdy quantity remains to be required to verify a sustainable bullish breakout.

Macroeconomic Components Stay a Key Affect

Regardless of encouraging technical alerts, SOL’s outlook stays closely formed by the broader international market surroundings. A brand new U.S. tariff coverage focusing on imported electronics from Asia – together with mining gear and blockchain-related {hardware}, has raised issues amongst buyers. It is a key motive why the Worry & Greed Index stays at 31, firmly in “worry” territory.

As well as, persistently excessive rates of interest in america have contributed to capital outflows from threat property like crypto, together with a weak restoration within the inventory market. Each worth rally has sparked sturdy profit-taking, creating invisible stress.

Nevertheless, there are indicators that the U.S. Federal Reserve (Fed) could think about chopping rates of interest if financial situations deteriorate, significantly if the brand new tariffs set off a recession. Fed could introduce stimulus measures if wanted to help financial progress.

What’s Maintaining SOL Resilient?

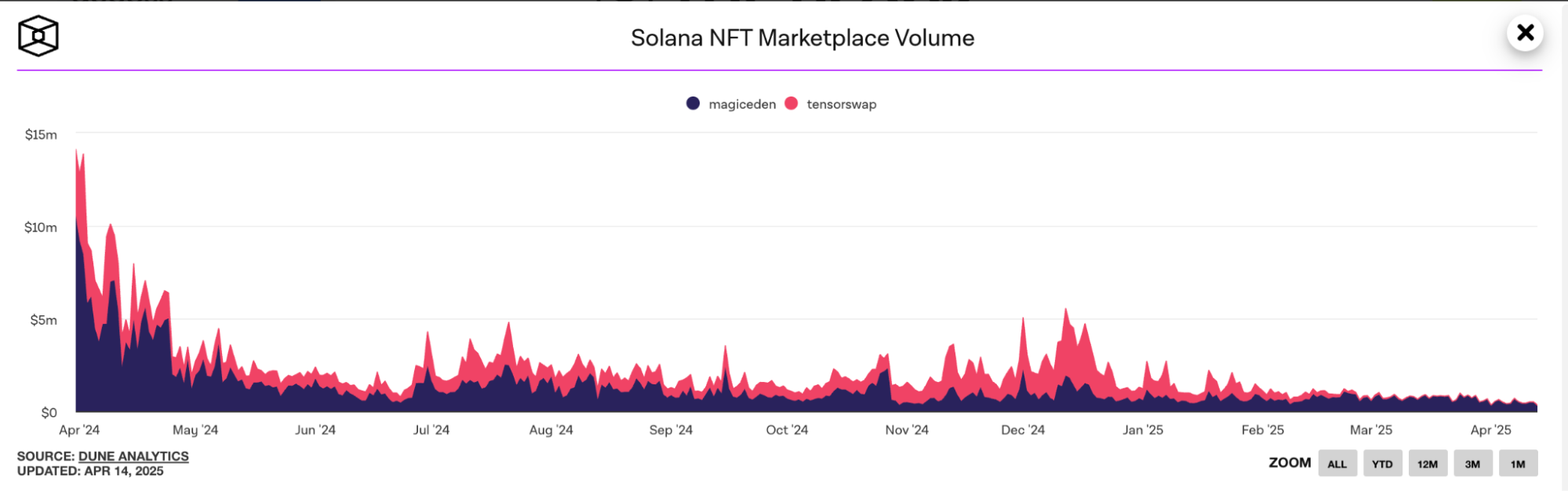

Amid ongoing volatility within the broader crypto market, the Solana ecosystem continues to point out sturdy momentum—significantly within the NFT and memecoin sectors. Platforms like Magic Eden and Tensor, and the rising reputation of memecoins, are taking part in an important function in sustaining exercise throughout the Solana community.

The colourful NFT panorama has contributed considerably to community utilization, offering a basic help layer for SOL’s worth.

Magic Eden stays the main NFT market on Solana, presently accounting for roughly 95% of all NFT buying and selling quantity on the community.

Solana NFT quantity – Supply: The Block

In the meantime, memecoins are seeing explosive exercise. For instance, POPCAT has surged over 105% up to now 4 days, reaching a worth of $0.25. Whale accumulation exceeding $80 million, together with rumors of listings on Binance and Robinhood, has fueled this progress.

Equally, FARTCOIN has gained greater than 300% over the previous month, now buying and selling at $0.87 with a market cap approaching $1 billion.

A report from Gate.io reveals that about 64.9% of all SOL tokens sit in staking contracts, indicating sturdy long-term confidence within the community regardless of latest worth corrections. Though staking hasn’t surged considerably since then, the present stage clearly alerts that the majority SOL holders don’t plan to exit within the quick time period.

With SOL’s inflation charge set to steadily decline over time and a extra optimized staking reward schedule in place, the inducement for long-term token holding continues to strengthen. This phenomenon partly explains why, though SOL has dropped greater than 35% since early March, it continues to carry the $125–$130 help zone.

Solana Worth Prediction

Taken collectively, with technical indicators pointing towards a backside and whales persevering with to build up close to $130, these elements help the view that SOL might stage a stable restoration if macro situations stabilize.

Within the quick time period, a breakout above the $145 resistance stage would function a transparent affirmation of a bullish reversal.

Conclusion

Regardless of dealing with important stress from the macro surroundings, together with excessive rates of interest, U.S. commerce insurance policies, and a prevailing “risk-off” sentiment amongst buyers, the underlying fundamentals of the Solana ecosystem proceed to function a powerful basis supporting SOL’s worth.

So long as the help zone round $125 holds and macro situations don’t deteriorate instantly, SOL has a sensible probability of rebounding towards the $145 stage within the quick time period and probably regaining sustainable upward momentum within the mid-term.

Learn extra: ETH Worth Prediction in April: Quick & Mid Time period Evaluation