Este artículo también está disponible en español.

Crypto analyst Egrag has supplied an historic evaluation of the weekly XRP worth chart, suggesting that the cryptocurrency is getting into “uncharted territory.” Using historic knowledge and specializing in crucial technical indicators.

Egrag highlights vital shifts in XRP’s buying and selling conduct, emphasizing the exhaustion felt by the XRP group throughout this extended cycle. “This cycle has been extraordinarily exhausting and tremendous manipulative, particularly in relation to XRP. However don’t lose hope!” he states.

Why XRP Is In Uncharted Territory

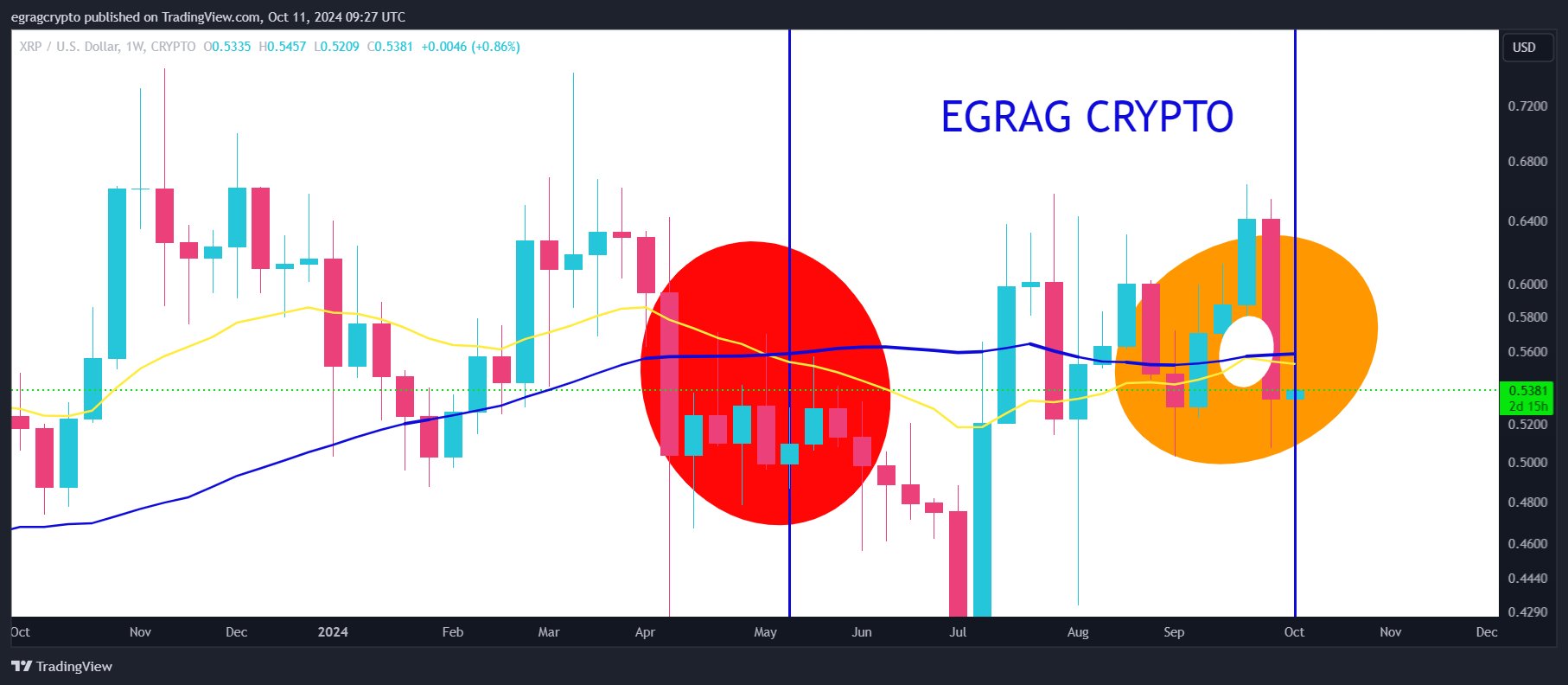

Central to Egrag’s evaluation are two key indicators plotted on a weekly scale: the 21-week Exponential Shifting Common (EMA) and the 55-week Easy Shifting Common (MA). Each indicators are famend for his or her responsiveness to cost adjustments and have traditionally been indicative of market momentum shifts for XRP. The interactions between these transferring averages, notably once they cross, are pivotal in forecasting potential bullish or bearish traits.

Associated Studying

Egrag identifies three forms of crosses in his evaluation, every signaling completely different market sentiments. A bearish cross, marked by a pink circle on his chart, happens when the 21-week EMA crosses beneath the 55-week MA, indicating potential downward momentum. A bullish cross, denoted by a inexperienced circle, occurs when the 21-week EMA crosses above the 55-week MA, signaling potential upward motion. An indecisive cross, represented by an orange circle, marks durations the place the transferring averages converge however don’t decisively cross, reflecting uncertainty or potential market manipulation.

In Cycle A, XRP skilled a bearish cross adopted by two bullish crosses, with vital implications for its worth trajectory. The interval from the bearish cross to the primary bullish cross spanned roughly 616 days, throughout which the market sentiment step by step shifted. Halfway via this cycle, there was one other bearish cross about 140 days after the primary bullish cross, previous the second bullish cross that occurred 49 days later. This second bullish cross led to an explosive worth motion. Egrag remarks, “We had a bearish cross, adopted by two bullish crosses—one halfway via the cycle and the second was explosive!

Associated Studying

Cycle B offered a distinct situation, that includes one bearish cross adopted by one bullish cross. The length from the bearish to the bullish cross was roughly 763 days, indicating a protracted interval of bearish sentiment earlier than the market shifted. Throughout this cycle, XRP narrowly missed an earlier bullish cross as a result of a major worth dump, which prevented the transferring averages from crossing as they may have in any other case. “Mid-cycle, XRP narrowly missed the bullish cross as a result of a serious worth dump,” notes Egrag.

At the moment, in Cycle C, XRP is exhibiting conduct that differs from the earlier cycles each in length and complexity. From the primary bearish cross to the primary bullish cross, the cycle lasted about 441 days, longer than in prior cycles. Subsequently, there was a interval of 399 days resulting in a second bearish cross. In complete, Cycle C has spanned roughly 987 days from the primary bearish cross, making it the longest cycle since XRP’s inception.

At current, the 21-week EMA and the 55-week MA are converging however haven’t decisively crossed, marked by an orange circle indicating an indecisive cross. Egrag expresses frustration at this growth, stating, “Proper now, each indicators (21 EMA & 55 MA) are within the orange circle—proper on the verge of a manipulated bullish cross that we narrowly averted. That is pure manipulation! ”

Egrag’s evaluation means that Cycle C’s unprecedented length and deviation from earlier patterns place XRP in “uncharted territory,” indicating that the market could also be poised for an end result not beforehand noticed. “After breaking down all these crosses, my takeaway is that Cycle C is completely different from Cycles A & B primarily based on the variety of crosses and length. We’re in uncharted territory, so we’re more likely to witness one thing new this time,” he asserts.

Nonetheless, Egrag stays optimistic in regards to the future. He envisions the potential onset of a ‘utility part’ for XRP, the place the main target shifts from speculative buying and selling to sensible functions of the cryptocurrency. “In my optimistic view, I hope that is the second the utility part kicks in, permitting us to make use of our XRP as an alternative of promoting it!” he concludes.

At press time, XRP traded at $0.53.

Featured picture created with DALL.E, chart from TradingView.com